Contra containment

The Prime Minister Scott Morrison speaking at an online Indian media briefing on 30 September:

“[W]e’re not seeking in any way to constrain China’s growth. Never have. We’re not in the containment club when it comes to China. We have greatly benefited from their economic development, and and [sic] they have been very successful indeed, as India has, in taking millions, hundreds of millions of people out of poverty. It’s quite a remarkable economic success. This is good. We welcome that. We think that’s great.”

Quick take:

These comments in response to a question about the Quad and China are consistent with longstanding Australian government positions. Despite the steep southward trend in bilateral relations, Australia continues to welcome China’s economic development and distance itself from containment policies. The Prime Minister’s remarks also include familiar praise of China’s monumental poverty reduction achievements, messaging which remains a mainstay of leader- and ministerial-level statements about China.

But despite these repeated and longstanding Australian assurances, China remains unpersuaded. On the same day as the Prime Minister was sounding positive notes about China, Ministry of Foreign Affairs (MFA) spokesperson, Hua Chunying, stressed: “AUKUS, like Quad [sic], is subservient to and serves the Indo-Pacific strategy with US dominance.” These kinds of criticisms of both AUKUS and the Quad as elements of the United States’ supposedly hegemonic designs mean Canberra is unlikely to be able to shift perceptions in Beijing, regardless of how often it emphasises and reemphasises that it welcomes China’s economic development and doesn’t support containment.

This doesn’t make such efforts at reassurance futile diplomacy. The case for Canberra seeking to counteract accusations of containment is still strong. Failing to offer any such reassurances would likely further compound China’s concerns about Australia’s goals and strategies. But considering that the Quad and AUKUS are among Australia’s most significant diplomatic and military initiatives of recent years and are only likely to grow in importance for Canberra in the coming years and decades, China’s suspicions of Australia are only likely to intensify.

Of course, this doesn’t mean that China’s suspicions are well-founded. The ongoing debates among US and Australian analysts about the nature of US strategic competition with China and Australia’s role in it suggest that it’s still an open question as to whether the US is seeking to contain China and what role Australia might play in such a US effort. But regardless of the accuracy of China’s analytical assessments about Australian and US policy, it seems increasingly clear that Canberra’s rhetorical reassurances face a daunting task in seeking to shift Beijing’s view of Australia.

Constraining China

US Secretary of Commerce Gina Raimondo speaking to CNBC:

“If we really want to slow down China’s rate of innovation, we need to work with Europe.”

Quick take:

Despite previous explicit US disavowals of containment, these kinds of statements will push the needle in Beijing further towards the conclusion that the United States is bent on obstructing China’s rise. Given the importance that the Party-state places on the economic and technological dimensions of China’s rise, moves to undermine the country’s innovation efforts are especially poorly received. Unsurprisingly, Beijing fired back with rhetorical flair. Per MFA spokesperson Hua’s comments: “The remarks of this US official again exposes the US true intention to contain and block China’s development by all means. This is quintessential autocracy and bullying.”

Consistent with repeated authoritative Australian government statements (see above and elsewhere), Canberra welcomes China’s economic development, supports its ongoing growth, and seeks mutually beneficial economic cooperation with China where possible. By contrast, the United States has embraced “strategic competition” with China as one of the organising principles of its foreign policy and senior US officials and lawmakers regularly make statements that could plausibly be interpretated as support for containment. This increasingly adversarial US policy towards China comes as Washington under the Biden administration seeks to align its allies and partners more closely with US goals and strategies and marshal their support in its effort to maintain US “global leadership.”

Regardless of the rights and wrongs of US and Chinese claims and counterclaims, Australia finds itself in a tightening bind. The combination of Beijing’s deep-seated distrust of Washington and the newly networked (i.e., allies- and partners-focussed) US policy of strategic competition with China makes it increasingly hard for Canberra to pursue its dual-track effort of supporting US leadership while disavowing containment of China. Just as Canberra welcomes deeper cooperation with Washington and expanding US diplomatic, economic, and military engagement in the Indo-Pacific, Beijing views precisely these initiatives as central elements of a US-led effort to contain China’s legitimate rise.

This is not to say that Canberra should distance itself from Washington for the sake of reassuring Beijing. (The substantive normative question of what Australia ought to do is much too large and complex to cover here.) What at least seems clear though is that China is likely to increasingly view Australia’s actions through the prism of what it believes is a concerted US-led effort to block its rise and undermine its interests.

Chinese diplomats and Party-state officials are presumably aware of Canberra’s efforts to distinguish its goals and strategies from Washington’s policy of strategic competition. But if even some Australian commentators and analysts judged that AUKUS could constrain Canberra’s ability to disentangle itself from Washington’s grand strategy, it’s easy to imagine policymakers and analysts in Beijing concluding that Australia will be irresistiblly pulled along by the momentum of US strategic competition.

Trade trends

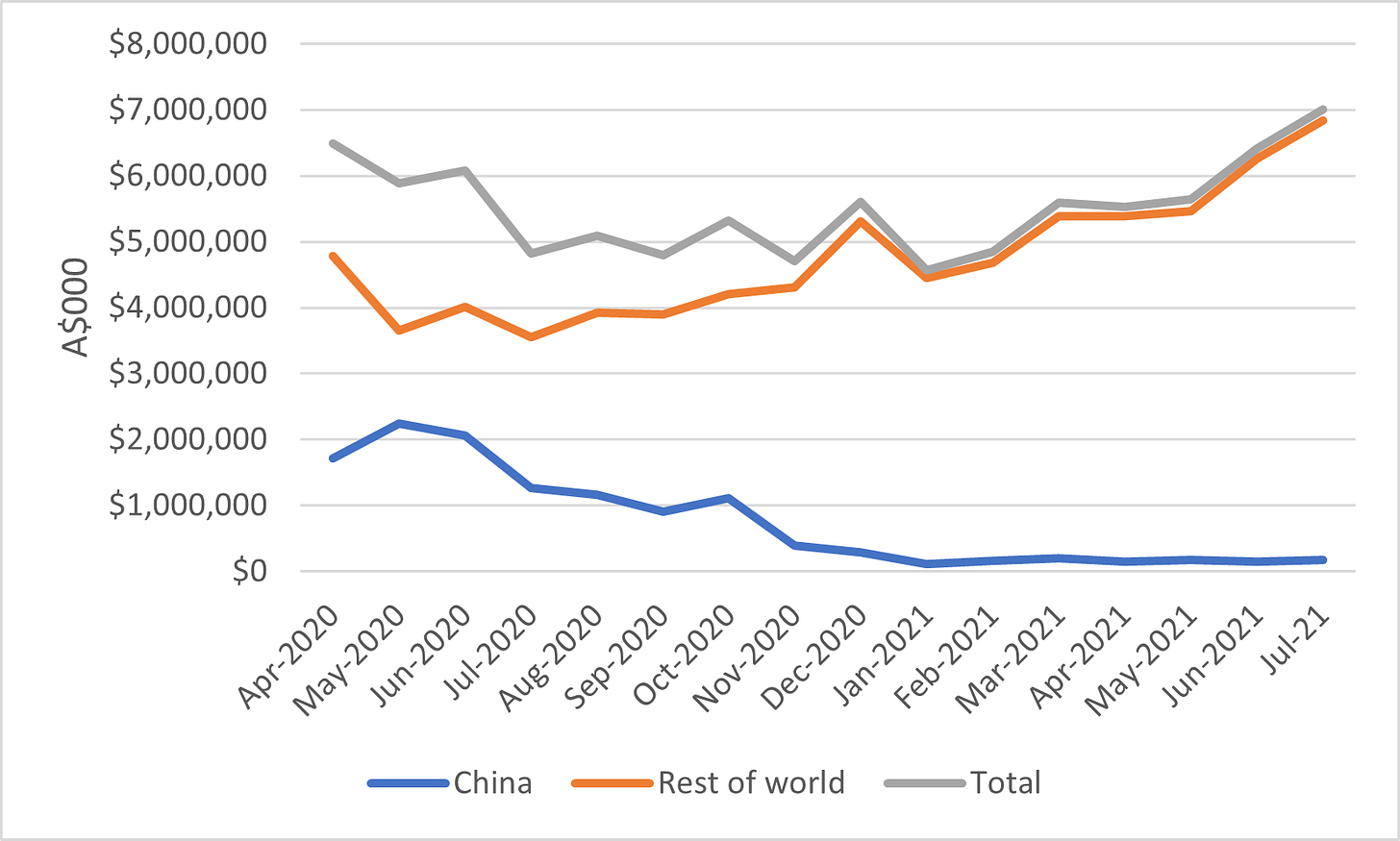

The combined monthly value of Australia’s nine exports targeted by China's trade restrictions (to China, the rest of the world, and total, April 2020 to July 2021):

Quick take:

The latest tranche of export data from July paints a relatively rosy picture of Australia’s exports, despite China’s sustained and severe trade restrictions. The data above covers all nine exports impacted by China’s confirmed trade restrictions: barley, beef, cotton, timber products, coal, copper ores and concentrates, sugar products, crustaceans, and wine. The value of especially lucrative mineral and energy exports to China, such as coal and copper ores and concentrates, was still flatlining at zero in July. Meanwhile, key agricultural exports were still frozen out of the Chinese market, with the value of barley exports to China still zero and alcoholic beverage exports (previously mostly wine) still a small fraction of their pre-trade restrictions levels.

But despite the downcast state of these exports to China, their value to the rest of the world tells a much more upbeat story. The total value of the nine targeted exports to the rest of the world continued to rise rapidly rise in July. Although the value of these nine targeted exports to China in July 2021 was approximately 1% of its value in April 2020, the value of these same nine exports to the rest of the world in July 2021 was approximately 143% of its value in April 2020. Meanwhile, the total value of these nine exports to China and the rest of the world in July 2021 was approximately 143% of its value in April 2020.

Presumably the rise in the value of the nine targeted exports to the rest of the world has been boosted by the dramatic surge in coal prices. Although other commodity price fluctuations may have played a role as well, the impact of coal prices is likely to be especially significant considering that coal is by far the largest Australian export targeted by China’s trade restrictions. But even excluding coal from the mix, the value of the other eight Australian exports to the rest of the world in July 2021 was approximately 171% of its value in April 2020. So, despite China’s ongoing trade restrictions, the latest export data seems to further confirm that Australian exporters excluded from the Chinese market have been able to redirect to alternative markets relatively effectively.

As always, thank you for reading and please excuse any errors (typographical or otherwise). Any and all objections, criticisms, and corrections very much appreciated.