Coal climbs again

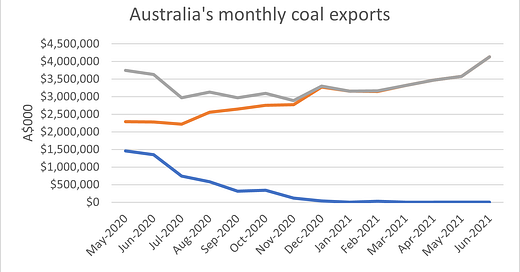

The monthly value of Australia’s coal exports to China, the rest of the world, and the total value, May 2020 to June 2021:

Quick take:

According to the recently released June trade data, Australia’s monthly coal exports to China are still flatlining at zero. But despite this, Australia’s exports to the rest of the world shot up again in June, jumping by more than half a billion dollars. Notwithstanding Beijing’s best efforts to punish Canberra, the value of Australia’s coal exports in June 2021 eclipsed their value in May 2020 when coal exports to China spiked to just shy of A$1.5 billion.

There’s good reason to be cautious of the implications of this though. Coal prices have surged in recent months, with the price for thermal coal in June this year being roughly double the price it was in October 2020 when reports emerged of China turning the screws on Australia coal. So, just as booming iron ore prices have made Australia’s trade relationship with China look rosier than it otherwise would be, surging coal prices have probably helped keep the value of Australian coal exports buoyant despite the burn of Beijing’s trade restrictions.

Iron ore under pressure

The Global Times’ GT Voice column on 19 August 2021:

“Australia is China’s main source of iron ore imports. Although there have been trade disputes between the two countries over a range of products, the previous surge in iron ore prices is widely considered to be a major factor in maintaining Australian exports to China at high levels amid their souring ties.”

“Yet, with the key variant, iron ore prices, returning back to a more regular range, the true state of China-Australia trade is likely to become clearer in the future.”

Quick take:

This Global Times’ column has a “bell tolls for thee” kind of vibe. But despite the ominous undertones, it makes sense that Australia’s export earnings from iron ore would dip and that exports to China would also start to slide. Brazil is the only country that comes remotely close to Australia in terms of the sheer quantity and value of iron ore exports, and its industry is bouncing back after a few troubled years. Meanwhile, China’s steel mills are under renewed pressure to curb output as the country pushes to reach carbon neutrality by 2060.

So, there’s no need to search out coercive intent from Beijing to find a powerful combination of price and demand pressures that presage declining fortunes for Australian iron ore exports to China. But even if coercion isn’t a factor for iron ore, iron ore price and demand pressures will make the impact of the very real examples of China’s coercive trade practices much clearer. In that context, it also isn’t surprising that the nationalistic Global Times would highlight emerging cracks in the shield that iron ore has provided for Australia’s overall trade relationship with China.

The iron ore colossus

The value of Australia’s iron ore exports to China in the first six months of 2021:

A$72.5 billion

Quick take:

This is an eye-watering number by any metric, but especially so considering that this is the value of just one export to just one market. It’s far above the value of the entirety of Australia’s annual exports to Japan—Australia’s number two export destination in 2020—and it’s roughly on par with the entirety of Australia’s two-way trade with the United States—Australia’s number two trading partner in 2020. It’s also more than double the annual value of Australia’s education exports, which were the country’s largest services exports in 2020 by a huge margin.

Given the above, it’s fair to say that iron ore’s likely price pressure from Brazil and softening demand from China will have significant and long-term reverberations throughout the Australian economy. Not least because of their impact on government coffers. Even though there are promising signs of the successful redirection of Australian exports to other markets in the wake of China’s economic coercion, there are potentially far more powerful headwinds building for Australia’s carbon-intensive exporters that are unrelated to Beijing’s efforts to punish Canberra.

As always, thank you for reading and please excuse any errors (typographical or otherwise). Any and all objections, criticisms, and corrections very much appreciated.