US force posture in Australia

Minister for Defence Peter Dutton speaking at a joint press conference at HMAS Stirling on 29 October:

“As we announced in Washington, essentially, every aircraft type in the US Defence Force will visit Australia at some point, will cycle through and when you think of the scale of that US machine, you can get a grasp of the significant investment that will be made. So, you know, I think that’s quite a phenomenal outcome of AUKUS for our country and we’ll see that play out over the next few years.”

Quick take:

Announcements about Australia’s planned acquisition of nuclear-powered submarines and additional US force posture in Australia were rolled out at different events in different places. Yet Minister Dutton’s framing seems to imply that they can be seen as part of a larger omnibus AUKUS package. Regardless of the nature of the connection between AUKUS and the additional US military presence announcements at AUSMIN, Beijing’s nonresponse (unless I’m missing something?) to the US force posture announcements is noteworthy. Especially considering Beijing’s voluminous objections to Australia’s planned acquisition of nuclear-powered submarines.

Was China’s quiet response to the US force posture announcements simply an oversight? Was it a product of the overwhelming focus of debate and analysis on the AUKUS submarine news and the associated diplomatic ructions between France, the AUKUS countries, and others? Or instead, is Beijing just much less concerned about future US force posture in comparatively distant Australia than it is about the possibility of additional Australian submarines on station for extended periods in the South China Sea and Taiwan’s maritime approaches?

Beijing’s cautious response to the 2011 decision to establish a rotational US Marines presence in Darwin might seem to give weight to the theory that China is broadly unconcerned about additional US force posture (relatively) far away in Australia. Despite not welcoming the 2011 announcement, Beijing responded with restrained language. The Chinese Ministry of Foreign Affairs (MFA) spokesperson at the time noted: “Whether it suits the common interests of countries around the region and the whole international community remains under question.”

Although there might be parallels to be drawn between China’s reactions in 2011 and 2021 to US force posture announcements, comparing these datapoints is a stretch. There’s a massive military-strategic difference between US Marines in Darwin and potentially long-distance and nuclear-capable US bombers at Australian airfields. Moreover, Beijing’s relations with both Washington and Canberra have dramatically deteriorated since 2011, which makes China’s nonresponse to US force posture announcements especially surprising.

Whether Beijing ramps up its criticism of these US force posture initiatives once US aircraft start landing at Australian airfields and other US platforms arrive remains uncertain. But given the change in strategic circumstances between 2011 and 2021 and the potency and reach of some of the US military platforms that could visit Australia, the likelihood of more diplomatic broadsides from Beijing seems high. As strong as China’s criticisms of the planned capability acquisition aspects of AUKUS have already been, the US force posture elements of AUSMIN may yet elicit more objections.

Indonesia and China on AUKUS (again)

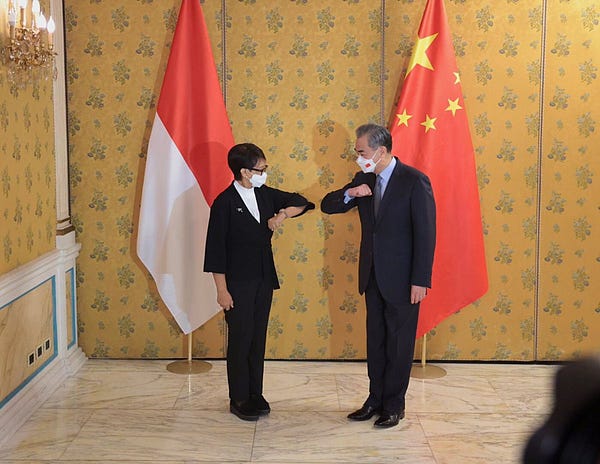

Per the MFA readout of Foreign Minister Wang Yi’s meeting with his Indonesian counterpart Retno Marsudi on 30 October:

“The two sides also expressed grave concern over the risk of nuclear proliferation caused by the plan for nuclear-powered submarine cooperation of the AUKUS.”

Quick take:

Despite the Prime Minister’s best efforts to reassure ASEAN, Indonesia remains deeply sceptical. Although the Indonesian readout of this meeting doesn’t appear to be available, it is noteworthy that the two foreign ministers were willing to explicitly name AUKUS when criticising the security partnership. Although both Beijing and Jakarta have already mentioned Australia’s nuclear-power submarine acquisition plans explicitly in their own messaging, the previous bilateral intervention on the AUKUS security partnership was oblique (though the context admittedly left little doubt as to which countries were being held to account).

Given the Indonesian government’s ongoing support for the Non-Aligned Movement (NAM), this disconnect between Jakarta and Canberra is hardly surprising. Foreign Minister Marsudi’s speech marking NAM’s 60th anniversary bears a strong resemblance to familiar elements of Beijing’s diplomatic messaging about not just AUKUS, but also what China often decries as the “Cold War mentality” of the United States and its allies. Chinese diplomats could have just as easily expressed Foreign Minister Marsudi’s sentiment that a “zero-sum approach” is ill-suited to tackling humanity’s greatest challenges and that “[g]eopolitical rivalries threaten our ways of working together in addressing … global challenges”.

To be sure, there’s a danger in overinterpreting the significance of the rhetorical resonance between Jakarta’s and Beijing’s messaging. Notwithstanding their shared concerns about the trilateral security partnership, Indonesia and China are still separated by deep strategic divides, including large overlapping claims regarding maritime jurisdiction in the southern reaches of the South China Sea. But regardless, the similarities between the ways in which Jakarta and Beijing view not just AUKUS but also great power politics and strategic competition suggest that Australia’s efforts to reassure Indonesia still have a long road to travel.

The foreign investment blame game

MFA spokesperson Zhao Lijian speaking at the regular press conference on 27 October:

“The responsibility of the drop in Chinese investment in Australia fully rests with the Australian side. For a while, some in Australia have been politicizing and stigmatizing normal economic and trade cooperation between China and Australia at every turn and wantonly restricting normal bilateral exchange and cooperation. This has disrupted the sound momentum of practical cooperation and dampened Chinese companies’ confidence in investing in Australia.”

Quick take:

“It’s not me, it’s you” is now a familiar MFA refrain when questions come up about deteriorating Australia-China relations. Typically, Australian ministers and officials reject this characterisation, reemphasise that Canberra won’t compromise on the points of contention, and highlight by way of a response what they consider to be Beijing’s malfeasance. Australia’s statement last month to the World Trade Organization Trade Policy Review of China is a case in point of such a diplomatic counterpunch. Other examples abound (here, here, and here).

However, the dynamic in the debate over Foreign Direct Investment (FDI) is a little different. Even though Australian ministers and officials might reject the claim that responsibility for declining Chinese FDI “fully rests with the Australian side”, they would also likely accept that Australian policy settings are playing a significant role. They would also likely judge that this decline in Chinese FDI wasn’t per se a negative development given that it is, at least to an extent, an unsurprising by-product of the growing emphasis on national security considerations in the Foreign Investment Review Board’s (FIRB) decision-making. As FIRB’s Chair David Irvine observed recently: “Australia is actually not alone in taking greater account of national security issues in its investment regimes.”

The Minister for Trade, Tourism and Investment Dan Tehan has expressed optimism that the easing of border restrictions will be a positive development for Chinese FDI in Australia. Speaking last week to CNBC, the Minister said: “We’ve seen FDI drop by over 50 per cent as a result of the pandemic, but there’s a real hunger and appetite out there from investors, from the commercial sector, to look at Australia and get back investing in big numbers in Australia again. So, the reopening of Australia is important for our economic relationship with China as it is with every country across the globe.”

But even if 2022 sees an uptick, Chinese FDI into Australia is likely to face strong and long-lasting headwinds given FIRB’s greater emphasis on national security considerations combined with Beijing’s efforts to foster a stronger alignment between the Party-state and the country’s corporate sector. So, China might continue blaming Australia for these slumping FDI flows. But unlike other negative metrics of the Australia-China relationship, Canberra is unlikely to see a strong rationale for trying to dramatically change the trendline.

As always, thank you for reading and please excuse any errors (typographical or otherwise). Any and all objections, criticisms, and corrections are very much appreciated.