US-Australia on economic coercion, Beijing blames Canberra (again), and FDI flows

Fortnight of 28 March to 10 April 2022

A united front on economic coercion

From the 29 March joint statement issued by Australian Minister for Trade, Tourism and Investment Dan Tehan and the United States Trade Representative Katherine Tai:

“Minister Tehan and Ambassador Tai discussed their shared concerns over the use of coercive trade actions and non-market-oriented policies and practices and affirmed their commitment to effectively deter and address these harmful policies and practices, which threaten the livelihoods of our citizens, harm our workers and businesses, and undermine the rules-based multilateral trading system. They committed to working together to seek support from other interested partners to tackle these practices head on.”

“The Ministers opposed the use of trade-related economic coercion to pressure or influence the legitimate decision-making of sovereign governments. They also expressed serious concern over the use of non-market policies and practices, including: industrial policies and practices that promote excess capacity; pervasive subsidization; discriminatory and anti-competitive activities of state-owned or -controlled enterprises; the arbitrary or unjustifiable application of regulations; forced technology transfer; state-sponsored theft of trade secrets; government interference with or direction of commercial decision-making; and insufficient regulatory and market transparency.”

“Minister Tehan and Ambassador Tai reiterated the shared commitment of Australia and the United States to maintaining an open, rules-based multilateral trading system and, working together with like-minded countries and other interested partners, to identify, prevent, deter, and address trade-related economic coercion and non-market policies and practices, including through the World Trade Organization (WTO). The Ministers discussed cooperation in WTO committees and in disputes to challenge these policies and practices, as well as the sharing of information, data, and analysis and the development of new tools.”

Quick take:

By my record, this is one of the strongest and most detailed government statements issued on economic coercion yet. This statement also deals with other non-market policies and practices but I still can’t recall a recent unilateral, bilateral or multilateral communique on the issue like this. Admittedly, this joint statement seemingly wasn’t accompanied by much in the way of concrete policy initiatives to respond to economic coercion. But that such a statement was made at all is significant. Its detailed nature is especially noteworthy considering that when Minister Tehan met Ambassador Tai less than a year ago in July 2021, economic coercion received a flat and pretty perfunctory mention. This recent joint statement was also followed a day later by a similar statement issued with Secretary of Commerce Gina Raimondo. That second statement was more rhetorically parsimonious on economic coercion but hit many of the same points.

These joint statements are a diplomatic win for Australia. Such shared messaging is testament to the successes of Canberra’s nearly two-year long campaign to rally international opposition to economic coercion. These strong signals from the Biden administration cap off an Australian campaign that has seen more than 11 countries and multilateral groupings join Australia (in some cases multiple times) and express shared opposition to economic coercion. Despite the diplomatic wins, there’s much less clarity regarding both the concrete follow-on action and the contrast these statements attempt to create between China and the United States/Australia.

It’s not obvious that there’s a big joint agenda that Canberra and Washington can pursue to operationalise their shared opposition to economic coercion beyond diplomatic signalling and action in the WTO. (On some other options for joint US-Australia action, this co-authored paper from my ANU colleague Darren Lim is a handy guide for policymakers.) To be sure, avenues like diplomatic signalling and WTO action are valuable. But jointly responding to economic coercion is hard if one wants to avoid the risks of escalatory retribution while also simultaneously adhering to the global rules-based trading system. And it’s especially hard if one’s allies and partners don’t want to distort markets by directing their companies to assist exporters that have been adversely impacted by trade restrictions. (None of this is to say that Australia doesn’t have options to individually respond to economic coercion. It continues to pursue an active policy agenda in that space focused on new export opportunities and additional support for Australian businesses.)

Meanwhile, the resurgence of economic statecraft even among economically liberal states makes it much more difficult to draw hard and fast distinctions between what one judges to be the nefarious practices pursued by other states and one’s own geoeconomic policies. The Tehan-Tai joint statement’s complaints regarding “non-market policies and practices” can be justifiably levelled at Beijing. But at least some of these same grievances could be made against the United States and, arguably in certain cases, Australia. For example, a plausible case could be made that both the Australian and US governments have at times in engaged in “trade-related economic coercion and non-market policies and practices” via a range of tariffs, sanctions, export controls, and state-backed strategic investments.

None of this is intended to draw a moral or economic equivalence between the Chinese government’s policies and those of the US and Australian governments. But it is to say that the age of resurgent economic statecraft makes it much harder to contrast (in an unambiguous way) those states that pursue broad-based geoeconomic polices and those generally economically liberal states that increasingly pull the levers of economic policymaking in a bid to deliver what they consider to be necessary strategic effects. There’s much more to say on this (hopefully another time) but one of the by-products of the return of geoeconomics is a gradual and partial but nonetheless very real blurring of previously clearer divisions between free-market and state-directed economies. This coincides with policymakers in economically liberal states being pushed to engage with a proliferation of complex and morally ambiguous calculations about precisely how deeply to embrace economic statecraft.

Beijing lobs the ball back in Canberra’s court

China’s Ministry of Foreign Affairs (MFA) Spokesperson, Zhao Lijian, speaking at the regular MFA press conference on 1 April:

“In the spirit of openness, inclusiveness and mutual benefit, China is committed to building an open world economy and sharing development opportunities with other countries. Australia has benefited greatly from its cooperation with China and is a beneficiary of China’s development. The accusation of ‘economic coercion’ cannot be levelled against China. Instead, it is Australia that stands guilty of the following. It has taken measures against market principles and even bullying acts, and imposed unwarranted restrictions on normal exchanges and cooperation between the two countries, disrupting the good momentum of bilateral practical cooperation. Meanwhile, it has played the victim to put the blame on China, ganged up to pressure China, and grossly interfered in China’s internal affairs and harmed China’s core interests in violation of international law and basic norms governing international relations.”

“The responsibility of the current difficulties in China-Australia relations lies entirely with the Australian side. It is imperative that Australia face up to the crux of the setbacks in bilateral relations, abandon the Cold War mentality and ideological bias, respect basic facts, take an objective and rational look at China and its development, earnestly follow the principles of mutual respect and equality when handling bilateral relations. The Australian side should also stop playing up ‘China coercion’ narrative for selfish political gain and do more to enhance mutual trust and strengthen cooperation.”

Quick take:

This was quite a comprehensive spray. Zhao has a reputation for being an especially combative MFA spokesperson. But this was a pummelling even by his standards. Amidst a range of familiar criticisms of Australia, two points stood out for me. First, Beijing still seems intent on waiting for a diplomatic olive branch or policy concession from Canberra before considering any roll back of trade restrictions. Second, not only does China still periodically deny that it’s using economic coercion against Australia, but it sees Canberra as the original instigator of coercive practices in the form of Australian restrictions on foreign investment, among other factors. (Of course, this second point may not be sincerely believed by political leaders and officials in Beijing. But that the MFA Spokesperson used this framing at least suggests that China would like to persuade others that its subsequent trade restrictions are on some level a justified response to Australia’s securitisation of foreign investment review processes.)

Zhao’s statement makes for a striking study in contrasts when placed alongside a long line of conciliatory messages from the Chinese Embassy in Canberra. As I’ve written previously (here, here, here, here, and here), there’s been a consistently softer rhetorical tone from senior embassy representatives since roughly December 2021. What does the contrast between the diplomatic demeanour of the MFA Spokesperson and the Chinese Embassy mean? My sense, probably not much. As I’ve suggested previously regarding Chinese Embassy statements, Beijing seemingly still expects Canberra to make compromises of some kind.

A preferred turn of phrase used by the recently arrived Chinese Ambassador is: “joint efforts to push forward China-Australia relations along the right track.” This way of looking at what’s needed to improve bilateral ties implies that responsibility for frosty relations also lies at Australia’s feet (i.e., the Australian part of the “joint efforts”). (Whether the action that Canberra is expected to take is a substantial policy concession or a largely symbolic gesture remains unclear.) So, despite the overlay of hostile rhetoric, Zhao’s point may well boil down to a broadly similar message: ‘Australia, you need to demonstrate goodwill and compromise before bilateral relations will get back onto an even keel.’ Given the current political climate (and a range of other factors I’ve previously floated), the chances of that kind of compromise are low. So, it’s seemingly a case of plus ça change.

Foreign direct investment data

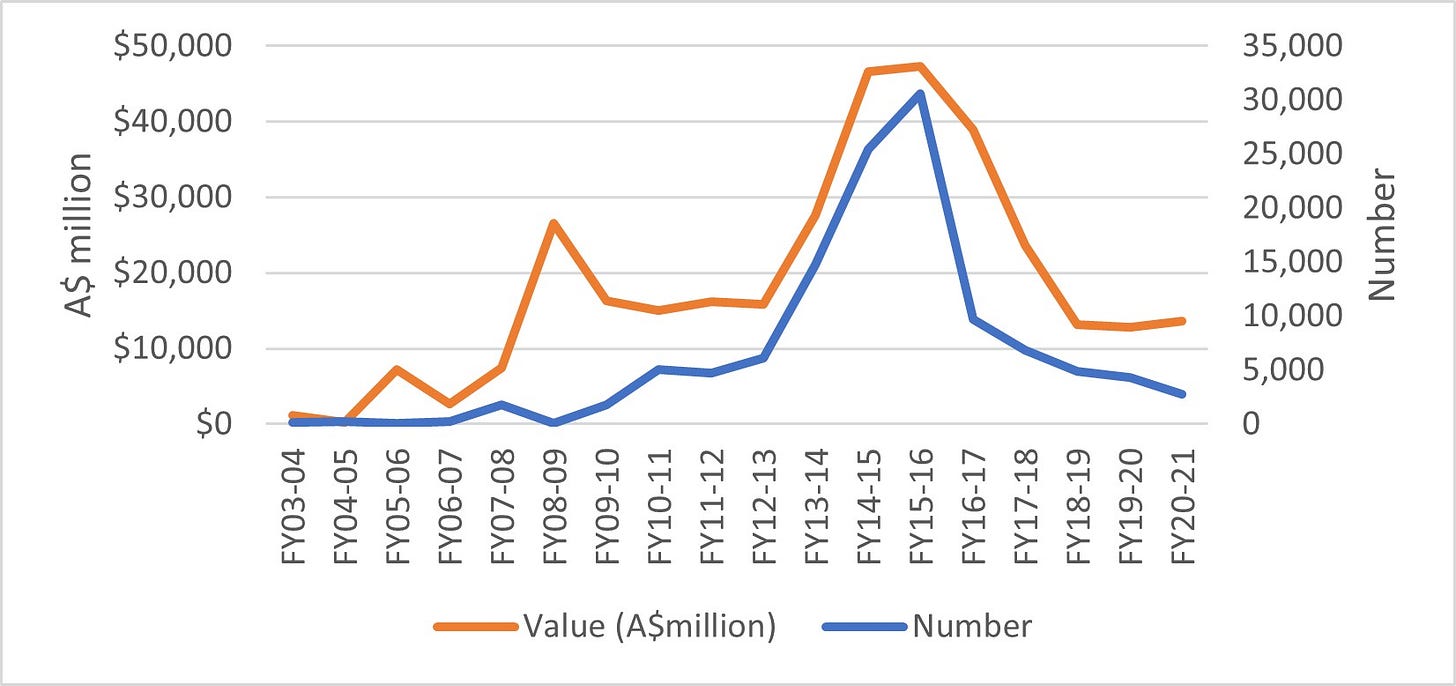

China’s annual foreign direct investment (FDI) into Australia by value (A$ million) and number of approvals, FY03-04 to FY20-21, incorporating data from the latest Foreign Investment Review Board’s Annual Report:

Quick take:

This latest tranche of FY20-21 FIRB data indicates that the decline in the value of Chinese FDI into Australia may have bottomed out. After collapsing dramatically between FY15-16 and FY16-17, the FY20-21 data shows a modest rise in the overall value of Chinese investments combined with a modest decline in the number of approvals for Chinese investments. With a focus on Australian policymaking, it’s tempting to attribute the declining fortunes of China’s FDI into Australia to growing security concerns surrounding certain types of Chinese investment. Such an inference might seem especially plausibly considering that the numbers of FIRB approvals involving investors from other major source countries does not experience a comparably dramatic post-FY15-16 drop.

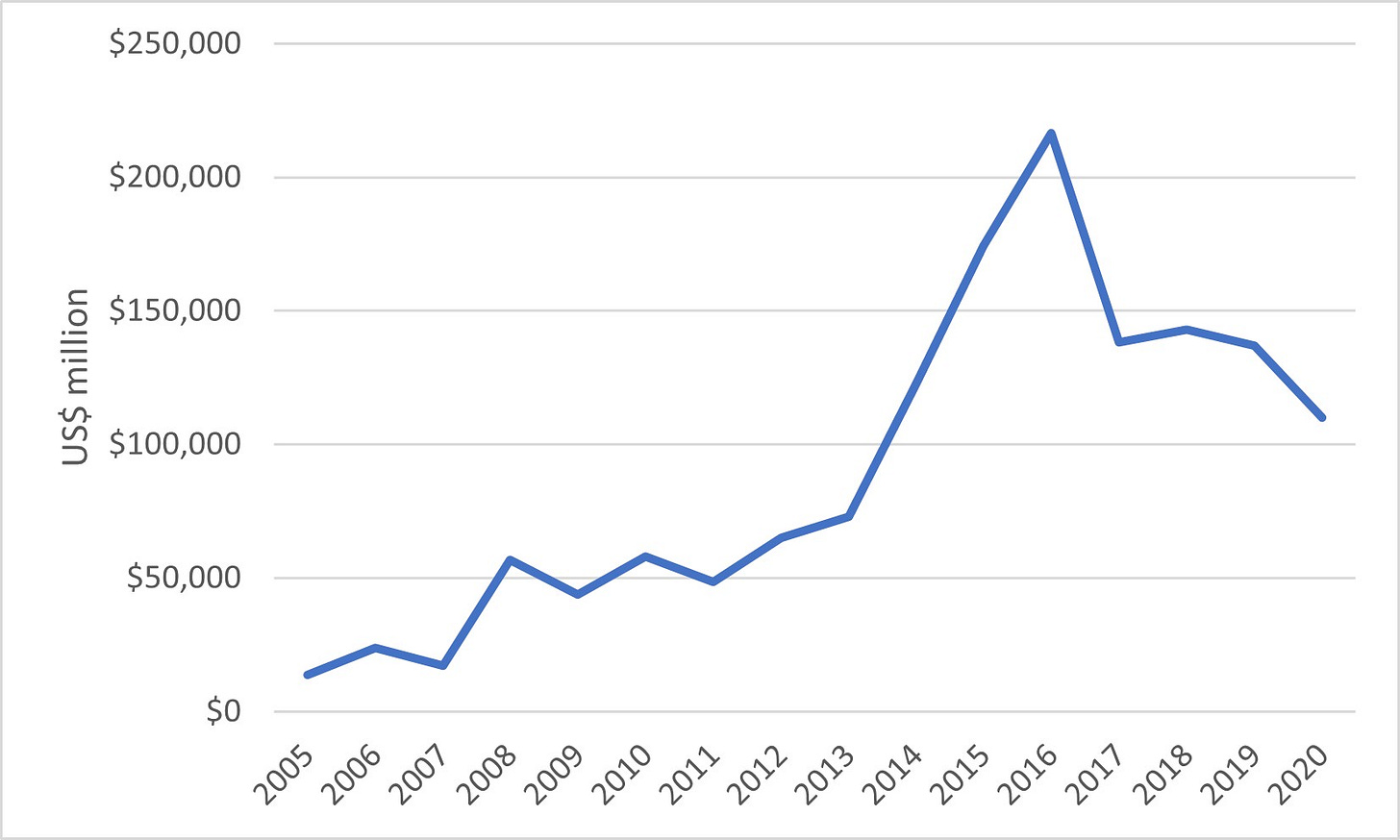

But the starkly downward trend in China’s FDI into Australia is presumably also partly a function of global trends in China’s FDI. After reaching a peak of US$216 billion in 2016, China’s FDI then fell suddenly in 2017 and had nearly halved to US$110 billion in 2020 (see below). The 2021 iteration of the below OECD data is not yet available but it’ll be interesting to see whether China’s global FDI flows roughly mirror the FY20-21 FIRB trends. That question notwithstanding, it seems unlikely that the decline in China’s FDI into Australia post-FY15-16 was simply a function of broader macro trends in the changing pattern of China’s FDI globally. Whereas China’s overall FDI in 2020 was 51% of its 2016 peak, China’s FDI into Australia in FY19-20 was approximately just 27% of its FY15-16 peak. This mismatch seems to suggest that the fall in China’s FDI into Australia in recent years was a product of factors beyond the fall in China’s FDI globally.

I hasten to add that I’m no expert on investment flows, so any corrections or extra context for this data would be especially welcome.

China’s annual global FDI by value (US$ million), 2005 to 2020:

As always, thank you for reading and please excuse any errors (typographical or otherwise). Any and all objections, criticisms, and corrections are very much appreciated.